Удаление различных загрязнений Рассмотрим самые распространенные виды пятен, которые оставляют следующие вещества: Сахар Расплавленную сахарную массу следует убирать, пока она не остыла. Для этого используют скребок, действуя медленно, без особого...

ВАШ ДОМ

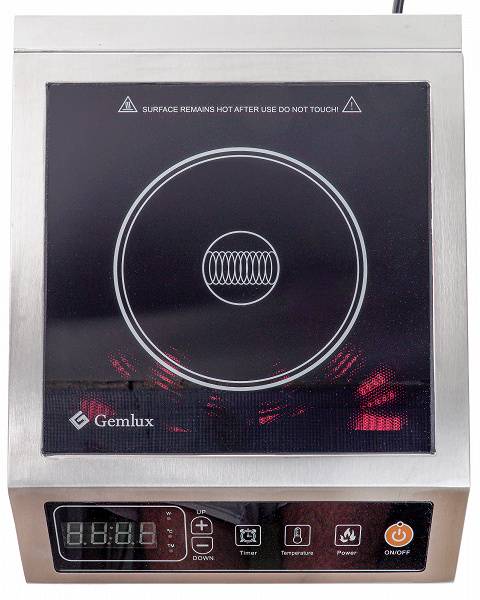

Все про технику, которая наполняет Ваш дом! Бытовая, кухонная, газовая, мелкая и крупная.